Ever noticed how property auctions seem straightforward until you actually consider participating in one?

After years of helping estate agents and property buyers navigate auctions through our comprehensive Let's Bid platform, we've compiled answers to the five questions we hear most often to help new and old auction enthusiasts quickly get to grips with this exciting way to buy a property.

How Do Property Auctions Work?

Let's cut through the mystique: at its core, an auction is simply a competitive bidding process where the highest bidder wins. But the details matter.

Traditional auctions bring bidders together in a physical venue. When the hammer falls, that's it—you're legally committed. You'll pay your deposit on the spot and have a short amount of time (often around 28 days) to complete. No backing out, no renegotiating, no changing your mind.

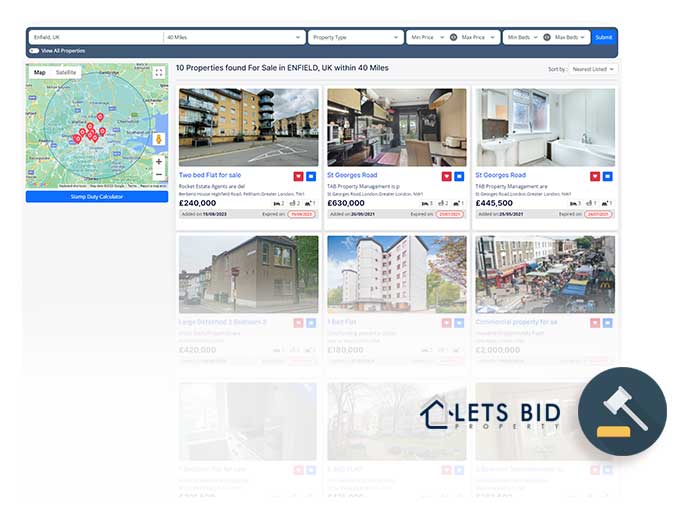

Online auctions through Let's Bid extend this process over several days. Our digital approach removes the pressure-cooker atmosphere of a traditional auction while still maintaining the transparency and certainty that make auctions attractive. More people can participate without travelling, and you can bid from your sofa at 11pm if that works for you.

Both formats give you something that's increasingly rare in property transactions: clarity. With Let's Bid, you know exactly where you stand, what you're competing against, and when everything will conclude. No more wondering if another buyer is about to swoop in with a higher offer while you're in the middle of conveyancing.

Why Do Properties Go To Auction?

Forget the outdated notion that auctions are just for problem properties. At Let's Bid, we see the reality is far more nuanced.

Speed and certainty drive many sellers to choose auctions through our platform. When you need to move quickly and can't afford a buyer pulling out at the last minute, the legally binding nature of an auction sale becomes incredibly attractive.

Executors handling probate properties often prefer Let's Bid's auction services because they demonstrate fair market value through transparent bidding—important when multiple beneficiaries are involved.

Properties with unique features that make conventional valuation tricky find their true value through competitive bidding on our platform. The same goes for homes needing substantial renovation—developers can see potential where typical buyers see problems.

Chain-breaking is another compelling reason sellers choose Let's Bid. After experiencing the frustration of a sale falling through because of issues elsewhere in a property chain, many sellers turn to our auctions to eliminate that risk entirely.

And contrary to what many believe, Let's Bid auctions can actually achieve premium prices, especially when multiple interested parties drive bidding upward in ways that calm negotiations never would.

How Do I Buy A Property At Auction?

Success at a Let's Bid auction belongs to the prepared. Here's what you need to do:

-

Research thoroughly - Get the legal pack and actually read it. All of it. Those property information forms, title deeds, and searches contain crucial information that might affect your bidding decision.

-

View in person - Photos can hide a multitude of issues. Always see the property yourself, and consider bringing a surveyor if you have concerns about the structure.

-

Sort your finances first - This isn't the time for "maybe" financing. Have your mortgage agreement in principle or cash funds ready before you raise your hand or click that bid button on the Let's Bid platform.

-

Set a firm maximum bid - Auction excitement is real. Decide your ceiling beforehand and stick to it, no matter how caught up you get in the competitive atmosphere.

-

Complete registration formalities - Let's Bid has specific requirements for identity verification and deposit arrangements. Sort these before bidding day to avoid last-minute stress.

-

Understand the bidding process - Know how to make your intentions clear through our intuitive online platform.

Remember: once the hammer falls or the online timer runs out on Let's Bid, you're legally committed. There's no "let me think about it" period, so your preparation needs to be comprehensive.

How To Buy Unsold Auction Property

Not every property finds a buyer during a Let's Bid auction, creating a potential opportunity for savvy purchasers. Here's how to approach these situations:

Reach out to the Let's Bid team immediately after the auction ends. We're motivated to secure sales for unsold lots and will often facilitate negotiations between interested buyers and sellers.

Understanding the reserve price is crucial—this is the figure the property didn't reach during bidding. Your offer will need to land somewhere near this number to be taken seriously.

Make your interest official with a written offer through the Let's Bid platform. Verbal interest is easily forgotten; documented offers demand attention.

While these sales don't happen at auction speed, they're still significantly faster than traditional purchases. Have your finances and legal support ready to move.

There's often room to negotiate terms on unsold properties. Sellers who've just watched their property fail to sell on Let's Bid are typically more flexible than they were before the auction began.

These properties can represent excellent value—sometimes the reserve price was simply too ambitious for the auction crowd, but still represents fair market value in a private treaty situation.

Do You Pay Stamp Duty On Auction Property?

Yes—the taxman doesn't care how you bought your property. Stamp duty applies to auction purchases just as it does to any other acquisition.

The same thresholds, rates and rules govern what you'll pay:

-

The purchase price sets the baseline

-

First-time buyer status may reduce your liability

-

Second homes or investment properties trigger a surcharge.

-

Your location matters (rates vary across the UK)

Factor this cost into your maximum bid calculations from the start when participating in Let's Bid auctions. The 14-day payment window after completion comes quickly, especially with auction purchases where everything moves faster.

This is particularly important for investors targeting auction properties. That additional 3% surcharge significantly impacts your numbers and needs to be accounted for before you start bidding.

Let's Bid's Property auction platform; strip away much of the uncertainty and delay that plague traditional property transactions. They're not right for every situation, but when speed, transparency and certainty matter, few approaches can match them. Whether you're buying or selling through Let's Bid, understanding these fundamentals puts you ahead of most participants—and in auctions, preparation almost always translates directly into better outcomes.